Insights

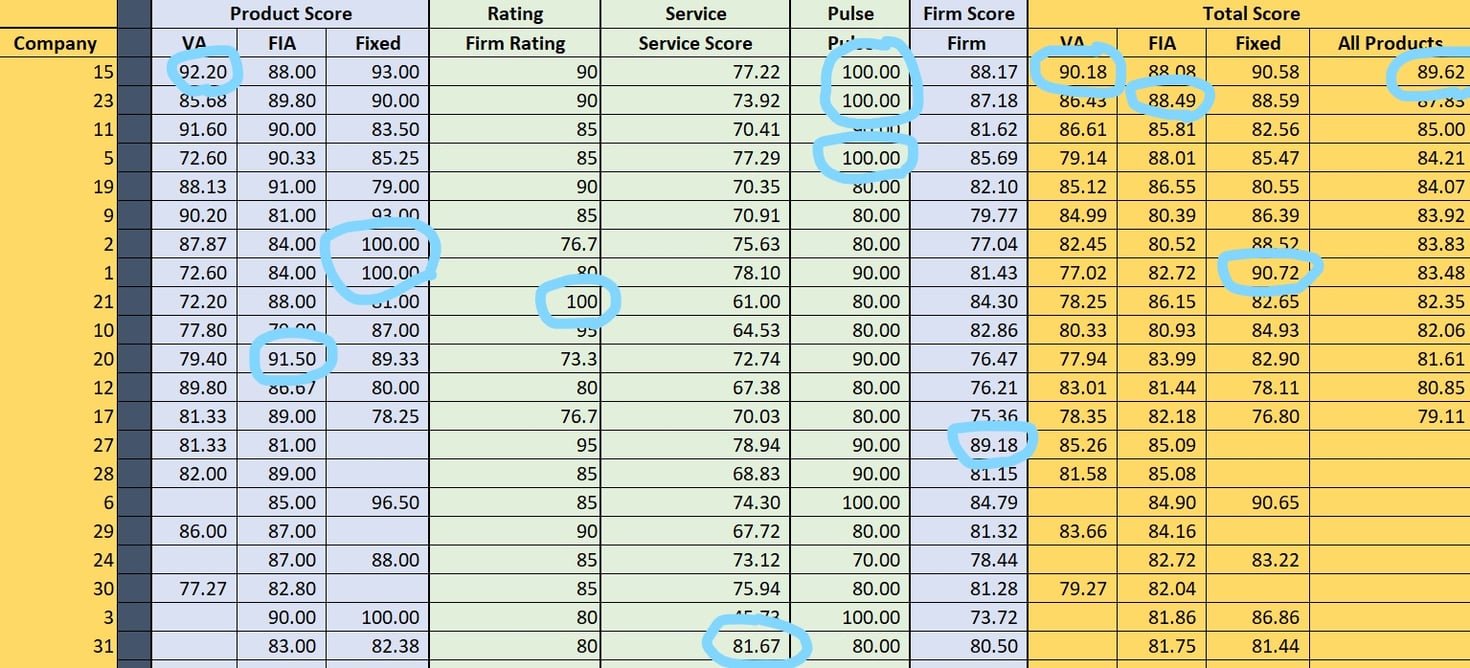

Product and Carrier Score

- DDW reviews the Carrier and the Product... Why?

- We have all seen what happens when you only look at one

- View a large amount of Product Information on one page through the Scorecard

- Benchmark your product universe, on a continuous basis

| Quarter | Variable Annuities | Indexed Annuities | ||

| Show me the Math | 5 Year Deferral | 10 Year Deferral | 5 Year Deferral | 10 Year Deferral |

| 2026 Q1 | ||||

| 2025 Q4 |

|

|

|

|

| 2025 Q3 |

|

|

|

|

| 2025 Q2 |

|

|

|

|

| 2025 Q1 |

|

|

|

|

| 2024 Q4 |

|

|

|

|

| 2024 Q3 |

|

|

|

|

| 2024 Q2 |

|

|

|

|

| 2024 Q1 |

|

|

|

|

| 2023 Q4 |

|

|

|

|

| 2023 Q3 |

|

|

|

|

| 2023 Q2 |

|

|

|

|

| 2023 Q1 |

|

|

|

|

| 2022 Q4 |

|

|

|

|

| 2022 Q3 |

|

|

|

|

| 2022 Q2 (incl VA May update) |

|

|

|

|

| 2022 Q1 |

|

|

|

|

| 2021 Q4 |

|

|

|

|

| 2021 Q3 |

|

|

|

|

| 2021 Q2 |

|

|

|

|

| 2021 Q1 |

|

|

|

|

| 2020 Q4 |

|

|||

| 2020 Q3 |

|

|

|

|

| 2020 Q2 |

|

|

|

|

| 2020 Q1 |

|

|

|

|

| 2019 Q4 |

|

|

|

|

| 2019 Q3 |

|

|

|

|

| 2019 Q2 |

|

|

|

|

| 2019 Q1 |

|

|

|

|

| 2018 Q4 |

|

|

|

|

Webinars

Blog posts

The Landmine List: When products blow up, how can your firm stay out of the mine field?

We are not talking about the universe of products that currently exist. We are only talking about those products that currently exist in the accounts of your clients and reside on your product platform.

The Annuity Product Manager you are looking to hire does not exist.

Annuity product management is a complex role requiring a diverse skill set. Discover how leveraging external experts can optimize your team’s performance and ensure comprehensive due diligence.

Announcing the DDW Carrier “Service Strength Score”

Introducing the DDW Carrier “Service Strength Score.”

Who Uses Our Services

Product Management

Product research reports at your fingertips. Industry insights. Benchmark your products vs the industry. Document your due diligence requirements.

Supervision / Compliance

Demonstrate review of Reasonably Available Alternatives. Documented process to maintain the best products on your shelf. Tools to support supervisory reviews.

Financial Professionals

See your product shelf in one place. Look for products from a client point of view. Compare products. Demonstrate review of Reasonably Available Alternatives.

Management

See the forest for the trees in your product area. Understand what your FPs are seeing. Protect and grow your firm.