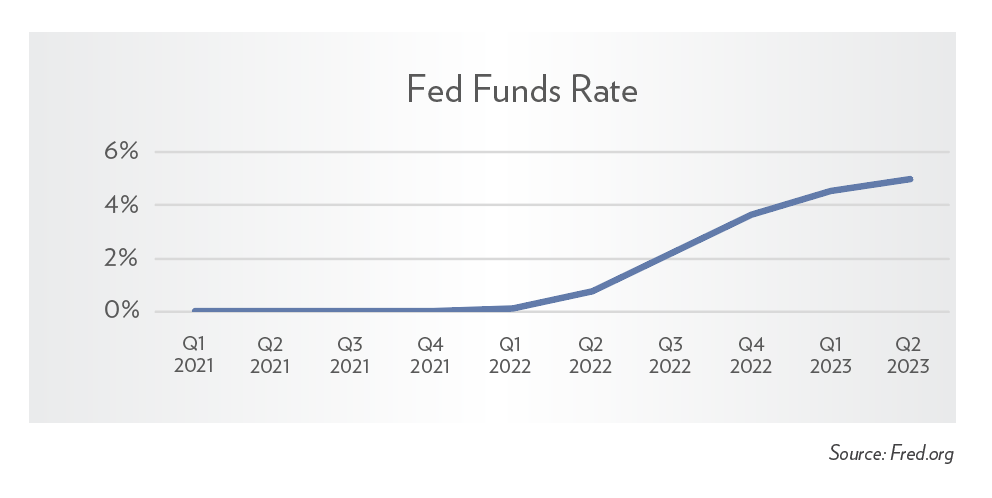

As the Fed continued to raise the Fed Fund Rate, what impact has this had on the annuity product lines? On the surface, we may know the answer; however, what does it really look like. In the following charts, DDW will compare how the different annuity lines fared in the increasing rate environment.

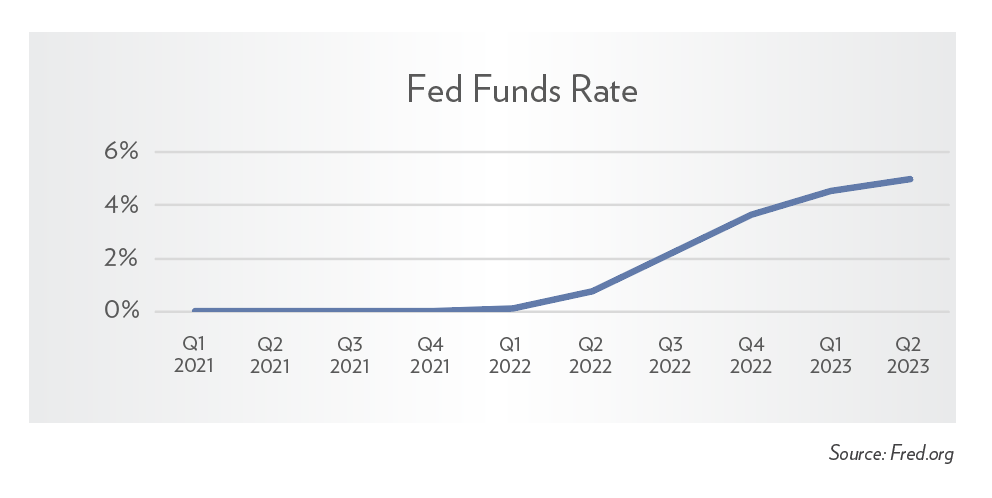

The Fed Funds Rate was drastically lowered in early 2020, dropping from 1.50% – 1.75% to .50%– .75% and further dropped to near zero, in response to economic conditions due to COVID. After several slight changes, the Fed Funds Rate was set a range of .25%– .50% in April 2022 which was the start of its upward movement. The Fed Funds Rate is currently set to the range of 5.25% – 5.5% for August 2023.

The Fed Funds Rate was drastically lowered in early 2020, dropping from 1.50% – 1.75% to .50%– .75% and further dropped to near zero, in response to economic conditions due to COVID. After several slight changes, the Fed Funds Rate was set a range of .25%– .50% in April 2022 which was the start of its upward movement. The Fed Funds Rate is currently set to the range of 5.25% – 5.5% for August 2023.

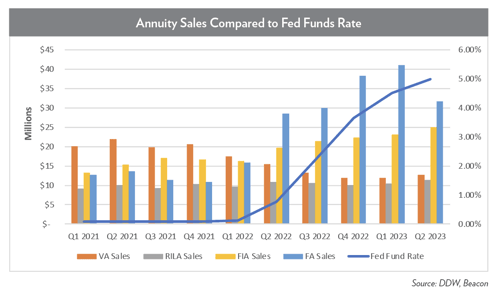

As the Fed Funds Rate increased, rate-driven products have capitalized on the continued increase in rates, especially fixed annuities. Fixed annuity sales have skyrocketed over the last three quarters. In the chart above, fixed annuity sales have mirrored the increase in Fed Funds Rate. In the most recent quarter, the chart does show fed funds stabilizing with either a decreasing growth rate or in fact holding steady, we also see Fixed sales stabilizing as well or even pulling back. History is interesting, if you are an historian, but we look at history to give us guidance as we look forward.

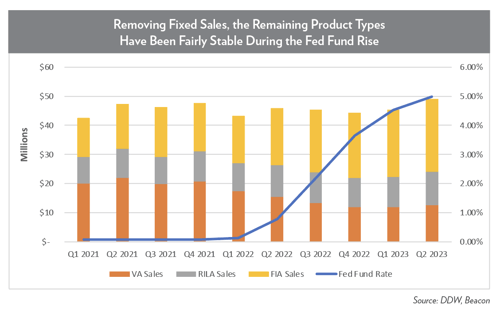

When we pull out the anomaly of Fixed Annuities and their large sales during the rising rate environment, we can see a slightly different view. VAs, RILAs, and FIA sales combined have held fairly constant over this time period, with the subtext of VAs have decreased about the same as Fixed Index have increased, and RILA’s remaining fairly constant. In the early stages of RILA, this product was taken market share from VAs, but this seems to have ceased.

When we pull out the anomaly of Fixed Annuities and their large sales during the rising rate environment, we can see a slightly different view. VAs, RILAs, and FIA sales combined have held fairly constant over this time period, with the subtext of VAs have decreased about the same as Fixed Index have increased, and RILA’s remaining fairly constant. In the early stages of RILA, this product was taken market share from VAs, but this seems to have ceased.

Looking at this across other investments products, annuities are behaving exactly like mutual funds and ETFs (see the Asset Flows article at the end of this publication). We have been in a risk off environment and the retail investor is investing in fixed income mutual funds, fixed income ETFs, and yes fixed or fixed index annuities. As with all past investment cycles, the retain investor usually lags the market (meaning they allocate to equities a little late in the cycle), but inevitably, VAs will make their come back along with other equity products in the market place.