Takeaway: In today's MLCD marketplace, where there is FDIC insurance, should you be offering MLCDs with lower caps?

Summary: As one of our clients said at the end of a discussion like the one below: “If I'm comparing apples to apples, why take the bruised ones?”

“Wash, Rinse, Repeat” has been the default strategy for building a product shelf of structured products for many firms. When a new month’s Structured Product calendar offerings are announced by all of the issuers, it’s easy to approve the same products as last month.

But in today’s marketplace, you need to take a deeper look for 2 reasons.

-

Small differences can have a major impact. Because products can look identical in almost every way, but differ in just one small way that could determine whether you “Accept” or “Reject” that product. (See example below.)

-

When it comes to MLCDs, FDIC insurance neutralizes the impact of an issuer’s credit quality and emphasizes the impact of cap rates.

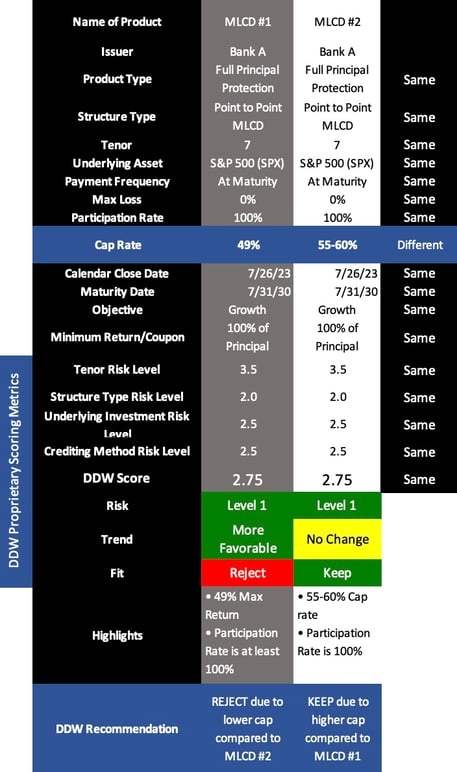

Here’s an example from this summer:

Notice how these two MLCDs are exactly the same in 17 out of 18 ways. But when it comes to the one way they are different, Cap Rates, the difference is enough to Keep MLCD #2 and Reject MLCD #1. (We have changed the names to protect the innocent.) Since they are both FDIC insured, some Product Managers might not be able to justify keeping the lower cap product. This is the kind of decision that requires paying close attention to all the details. You can’t just close your eyes to these important details in order to avoid getting soap in them when you “Wash, Rinse, Repeat” your monthly product shelf.

Exception: If we were comparing PPNs, where issuer strength underpins the principal protection (instead of FDIC for MLCDs), you might justify the structured product with the lower cap if that issuer has a higher credit rating.

One More Observation: Should we apply a MYGA compliance requirement to MLCDs? This reminds of us BDs that require Advisors to recommend the highest rate product for each MYGA duration. They might offer lower rate MYGAs of the same duration, but if the Advisor wants to recommend a lower rate MYGA to a client then they have to provide written justification and it must be approved by Sales Supervision.

Summary: As one of our clients said at the end of a discussion like the one above: “If I'm comparing apples to apples, why take the bruised ones?”

To Learn More About DDW...

Contact Mike Freeman

973.567.6600 | michael.freeman@duediligenceworks.com